Payment methods are a core part of the e-commerce experience. It is increasingly important for businesses to offer a variety of payment options to meet their customers’ preferences and needs, while also profiting from them. Customer preferences for e-commerce payment methods vary considerably around the world, and it is a constantly evolving sector. Internationally, debit and credit cards and digital wallets are the most popular e-commerce payment methods, but other payment methods, such as bank transfers and cash on delivery (COD), remain popular in certain regions. Mobile payments are also growing, particularly in markets with widespread smartphone adoption.

I’ll present the advantages and disadvantages of some payment methods:

Bank cards (debit and credit)

Advantages of using a bank card

- Cards are the most common form of payment. It’s rare to find someone who doesn’t have a credit card or at least a debit card.

- Accepting cards boosts sales. Bank cards are very easy to use, at least from the customer’s perspective. The “I see it, I want it, I buy it” cycle fits perfectly with impulsive credit purchases.

- Bank cards can be used to make purchases through PayPal. If you’re already using PayPal for your business, as most online freelancers do, then you can accept credit/debit card payments without requiring (or wanting) a PayPal account.

Disadvantages of using a bank card

- Comply with various laws and security regulations. Before accepting cards, you must comply with a number of security and data protection regulations to safeguard your customers’ data and prevent tax fraud.

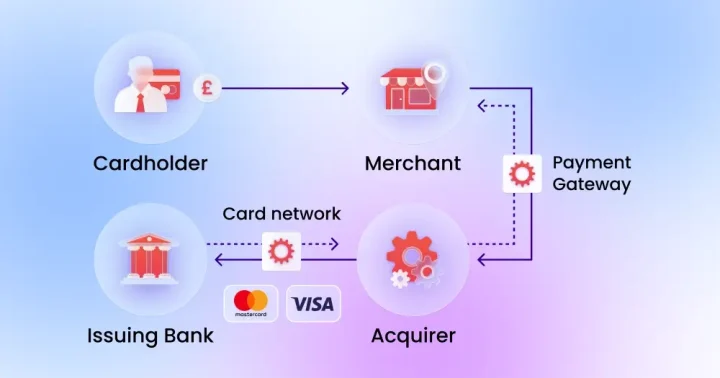

- Intermediation fees. Obviously, you will need to use a payment gateway to process credit and debit cards, and these services have a cost depending on the amounts you deposit.

Payments via mobile devices

This payment method actually comprises several different variations. In this article, we will only refer to payments you can send or receive via your mobile phone, whether through SMS, QR code, NFC, etc.

Advantages of using a mobile device

- Almost everyone has a mobile phone. Just like with credit cards, it’s hard to find someone who doesn’t carry one. It doesn’t matter if your customer pays via their phone or yours. The advantage of instant payment is there.

- Payments are usually very fast. You don’t have to think. Just take out your phone, and in a matter of seconds, the money is in your bank account.

Disadvantages of using a mobile device

- Security flaws. Some mobile payment methods still have some loopholes that make them not 100% secure.

- Not all card readers work the same way. If you’ve chosen a mobile payment system that involves using an app with your card reader, such as Square, PayPal, or Inuit GoPayment, then you’re likely to encounter some compatibility issues. Most card readers are compatible with iPhones, but perhaps not with other devices—research thoroughly before making a decision.

- Problems with updates. A single failed update can break the entire system and prevent you from collecting payments normally. So be very careful when updating the app you use for collecting fees, and make sure it’s compatible with your phone before installing it.

Electronic payments

It’s my favorite payment method. Electronic payment methods like PayPal are the most popular new methods among freelancers, entrepreneurs, and online sellers.

Advantages of electronic payments

- They are very simple. They are generally the easiest and quickest form of payment.

- They’re international. They open doors to the global market. It doesn’t matter where your client lives or what currency they want to pay you in. A freelancer in the United States can get paid by a client in Guatemala without any problems.

- They’re fast! Almost as fast as cash payments.

Disadvantages of electronic payments

- The fees are rather high. With a few exceptions, the costs associated with electronic payment systems are quite high. Sometimes, too high. The fee you have to pay will likely outweigh all the advantages I listed above, but if you’re going to collect a large invoice, consider using an alternative payment method.

These are some of the most popular payment methods available today. There are many different payment options, and you’ll undoubtedly need to choose the ones that best suit your business needs.

Here’s a list of the main e-commerce payment methods with one-line explanations for each:

- Credit/Debit Cards: The most common online payment method using Visa, Mastercard, or other cards.

- Digital Wallets: Services like PayPal, Apple Pay, or Google Pay store money digitally for easy online payments.

- Net Banking/Online Banking: Direct payment from a bank account via the internet.

- UPI (Unified Payments Interface): Instant payment system popular in countries like India for secure transfers.

- Cash on Delivery (COD): Payment is made in cash when the product is delivered.

- Cryptocurrency: Some e-commerce stores accept Bitcoin or other cryptocurrencies as payment.

- Buy Now, Pay Later (BNPL): Allows customers to purchase immediately and pay in installments later.